Life insurance is a crucial component of financial planning, providing peace of mind and security for your loved ones in case of the unexpected. However, not all life insurance policies are the same, and the rates can vary significantly.

|

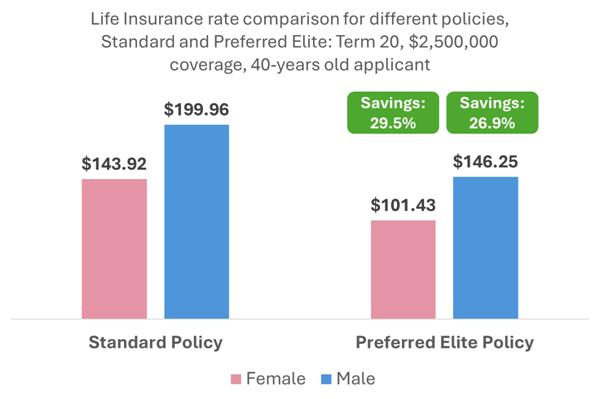

Preferred life insurance rates are offered to individuals who meet certain criteria, indicating they pose a lower risk to the insurance company. These rates are typically lower than standard rates, making them an attractive option for those who qualify. Understanding what these rates entail and how you can achieve them is important. Our chart below illustrates rate differences between male and female applicants for various life insurance policies: Standard (or Regular) and preferred Elite for a Term 20 life insurance policy with coverage of $2,500,000 for non-smokers

We asked four life insurance professionals to weigh in on preferred rates. Mathieu LeBlanc, Mathieu LeBlanc Consulting Inc. answered our questions about preferred rates in detail: |

Expert perspective: Barry Rubin, Director of Business Development at Beneva

This is not to say that all clients are not as healthy as they think, but consumers should know that only a small percentage of applicants get preferred pricing, so they shouldn’t feel that getting a non-preferred offer is a bad thing. Also check with the insurance company to find out what their guidelines are in order for someone to qualify for preferred rates. This will give the advisor and applicant an idea if preferred rates are something they should be expecting.” |

Preferred life insurance rates are offered to individuals who meet certain criteria, indicating they pose a lower risk to the insurance company. These rates are typically lower than standard rates, making them an attractive option for those who qualify.

Understanding what these rates entail and how you can achieve them is important. Our chart below illustrates rate differences between male and female applicants for various life insurance policies: Standard (or Regular) and preferred Elite for a Term 20 life insurance policy with coverage of $2,500,000 for non-smokers

We asked four life insurance professionals to weigh in on preferred rates.

Mathieu LeBlanc, Mathieu LeBlanc Consulting Inc. answered our questions about preferred rates in detail:

Expert perspective: Barry Rubin, Director of Business Development at Beneva

“A tip I frequently share with advisors is to set realistic expectations for your client. Most clients will tell us that they are healthy, but sometimes the insurance company views risk in a different way. An analogy is, a car may look great on the outside, but it is only after we pop open the hood and take a look at the engine that we can determine if the car needs some work and depending on how much work, will determine the offer the insurance company can make.

This is not to say that all clients are not as healthy as they think, but consumers should know that only a small percentage of applicants get preferred pricing, so they shouldn’t feel that getting a non-preferred offer is a bad thing.

Also check with the insurance company to find out what their guidelines are in order for someone to qualify for preferred rates. This will give the advisor and applicant an idea if preferred rates are something they should be expecting.”

What underwriting criteria do carriers look at when offering preferred rates?

|

“Typically the criteria includes a variety: build, blood pressure readings (including history of treatment), lipids (including history of treatment), family history (cancer, coronary artery disease, some companies consider diabetes others don’t), tobacco/nicotine product use history, participation in hazardous sports or avocations, alcohol/drug abuse history, marijuana use, etc. We also look at personal medical history (i.e. no medical conditions that are ratable at least +25. This is a rating that is usually absorbed into the standard rating; for example, you can be approved with an STD or a history of diabetes if you meet certain criteria, but this will also disqualify you for preferred rates). Also considered is your driving history including DUIs, and your occupation, which must not be rateable.” What are generally the face amount thresholds to qualify for preferred rates? “We will increase the limits in no-fluid underwriting; they tend to be in the $1,000,001 to $2,000,001 and up range (some companies’ limits are even higher).” Can you qualify for preferred rates as a smoker? “Some companies have a preferred smoker rate. You are still approved with smoker rates, but a slight discount is given relative to the standard smoker rates. For example, a company could offer Smoker Class 1, which is their best class for smokers who meet all the eligibility criteria, and Smoker Class 2, which would be the otherwise standard smoker rates.” |

Expert perspective: Casey Cameron, Founder of Camlife Financial

|

“Typically the criteria includes a variety: build, blood pressure readings (including history of treatment), lipids (including history of treatment), family history (cancer, coronary artery disease, some companies consider diabetes others don’t), tobacco/nicotine product use history, participation in hazardous sports or avocations, alcohol/drug abuse history, marijuana use, etc. We also look at personal medical history (i.e. no medical conditions that are ratable at least +25. This is a rating that is usually absorbed into the standard rating; for example, you can be approved with an STD or a history of diabetes if you meet certain criteria, but this will also disqualify you for preferred rates). Also considered is your driving history including DUIs, and your occupation, which must not be rateable.”

What are generally the face amount thresholds to qualify for preferred rates?

“We will increase the limits in no-fluid underwriting; they tend to be in the $1,000,001 to $2,000,001 and up range (some companies’ limits are even higher).”

Can you qualify for preferred rates as a smoker?

“Some companies have a preferred smoker rate. You are still approved with smoker rates, but a slight discount is given relative to the standard smoker rates. For example, a company could offer Smoker Class 1, which is their best class for smokers who meet all the eligibility criteria, and Smoker Class 2, which would be the otherwise standard smoker rates.”

Expert perspective: Casey Cameron, Founder of Camlife Financial

“Since COVID, the non-medical limits have become very high – usually $2,000,000 to $3,000,000 for under age 45. The higher limits have made preferred rates obsolete in the vast majority of cases. A workaround (with some carriers) to try for preferred rates may be to apply for $2M plus, do meds, and then request a lower face amount at issue. In practice, preferred rates almost never come up for me anymore.”

“Since COVID, the non-medical limits have become very high – usually $2,000,000 to $3,000,000 for under age 45. The higher limits have made preferred rates obsolete in the vast majority of cases. A workaround (with some carriers) to try for preferred rates may be to apply for $2M plus, do meds, and then request a lower face amount at issue. In practice, preferred rates almost never come up for me anymore.”

|

Can you qualify for preferred rates permanent policies? “Typically, preferred rates are only applicable to term policies.” Is it harder to qualify for preferred rates as you get older? “Yes, it is typically harder as you get older.” Are there lifestyle changes consumers can make to qualify for preferred rates? “Eating healthier and having an active lifestyle can have a direct impact on your build, blood pressure, and lipids. For some this can be the catalyst to stop smoking, consume less alcohol/marijuana, etc. So yes, many factors that are considered for preferred rates can be improved by making good lifestyle choices.” We invite you to reach out to us for a no-obligation consultation using a quoting box on the right. We understand that every situation is unique, and we are committed to helping you navigate through this important decision. Your peace of mind is our top priority and with access to 35+ insurers, we are the brokers that can find your best insurance solution. |

Expert perspective: Harpinder Galsi, Director, Business Development at HUB Financial

Preferred life insurance rates are offered to individuals who meet specific health criteria and are typically reserved for applicants who are in excellent health with a favorable medical history. Applicants who meet the criteria for preferred rates are considered less likely to file claims, which translates to lower premiums for the client. Insurance companies assess various factors to determine an applicant’s eligibility for preferred rates such as: Excellent Health: Applicants should have no medical issues and should be within the normal weight ranges for their height. They should also have normal blood pressure and cholesterol levels. Non-Smoker Status: Tobacco use significantly increases the risk of various health conditions. Typically non-smokers can only qualify for preferred rates, however some insurance companies have different tiers based on smoking status. Healthy Lifestyle: Applicants who live a healthy lifestyle by exercising regularly, balanced diet and limited alcohol consumption are more likely to qualify for preferred rates. Medical History: A clean medical history is usually required to qualify for preferred rates. Family Health: Insurance companies will also consider a client’s family health history as hereditary diseases or conditions can increase a client’s risk of making a claim. It is very important to note that meeting the criteria for preferred rates does not guarantee approval at those rates. For individuals that qualify, preferred rates can lead to significant cost savings over the life of the insurance policy. |

Can you qualify for preferred rates permanent policies?

“Typically, preferred rates are only applicable to term policies.”

Is it harder to qualify for preferred rates as you get older?

“Yes, it is typically harder as you get older.”

Are there lifestyle changes consumers can make to qualify for preferred rates?

“Eating healthier and having an active lifestyle can have a direct impact on your build, blood pressure, and lipids. For some this can be the catalyst to stop smoking, consume less alcohol/marijuana, etc. So yes, many factors that are considered for preferred rates can be improved by making good lifestyle choices.”

We invite you to reach out to us for a no-obligation consultation using a quoting box on the right.

We understand that every situation is unique, and we are committed to helping you navigate through this important decision.

Your peace of mind is our top priority and with access to 35+ insurers, we are the brokers that can find your best insurance solution.

Expert perspective: Harpinder Galsi, Director, Business Development at HUB Financial

“When qualifying for life insurance a key factor that influences premiums is the applicant’s health.

“When qualifying for life insurance a key factor that influences premiums is the applicant’s health.

Preferred life insurance rates are offered to individuals who meet specific health criteria and are typically reserved for applicants who are in excellent health with a favorable medical history. Applicants who meet the criteria for preferred rates are considered less likely to file claims, which translates to lower premiums for the client. Insurance companies assess various factors to determine an applicant’s eligibility for preferred rates such as:

Excellent Health: Applicants should have no medical issues and should be within the normal weight ranges for their height. They should also have normal blood pressure and cholesterol levels.

Non-Smoker Status: Tobacco use significantly increases the risk of various health conditions. Typically non-smokers can only qualify for preferred rates, however some insurance companies have different tiers based on smoking status.

Healthy Lifestyle: Applicants who live a healthy lifestyle by exercising regularly, balanced diet and limited alcohol consumption are more likely to qualify for preferred rates.

Medical History: A clean medical history is usually required to qualify for preferred rates.

Family Health: Insurance companies will also consider a client’s family health history as hereditary diseases or conditions can increase a client’s risk of making a claim.

It is very important to note that meeting the criteria for preferred rates does not guarantee approval at those rates. For individuals that qualify, preferred rates can lead to significant cost savings over the life of the insurance policy.